This form is for those who need to adjust their income for applying Student Loan or Working for Families Tax Credits .

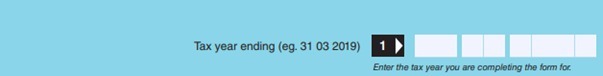

In column 1, fill in the tax year for which you need to make adjustments. For example, if you need to adjust your income for financial year 2019, fill in 31/03/2019.

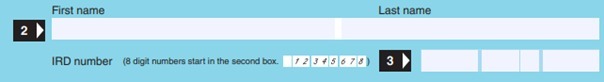

Fill in your name in column 2.

Fill in your tax number in column 3.

If your child has more than $500 in passive income, complete column 4.

In column 4A, fill in the name of the child whose passive income exceeds $500, in column 4C, fill in the tax number of the child, and in the last column, fill in the amount of passive income.If there is shared care, check 4B.

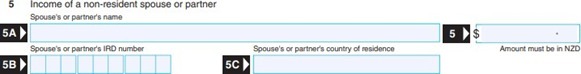

If your spouse or partner is not a NZ tax resident, complete column 5.In 5A, fill in the name, 5B, fill in the tax number, 5C, fill in the tax country of your spouse or partner, and finally fill in all their income in box 5.

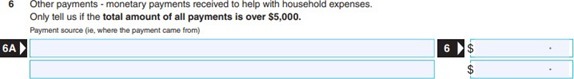

If there are any regular bills for your household that total more than $5,000, fill out box 6.

![]()

If you have a pension, you should declare in column 7.

If you have any depreciation recovery income resulting from the sale of fixed assets such as property, you should declare in column 8.

![]()

If you have any non-resident overseas income, please fill in box 9.

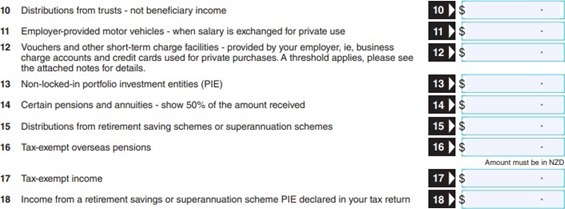

Columns 10-18 are about specific incomes, and if you don't have them, you can jump through them.

In Column 10, fill in all your non-beneficiary income.

In column 11, the employer's car is for your personal use.

Column 12, other FBT income except for private use of official vehicles.

Column 13, PIE income.

Column 14, annuity income.

Column 15, endowment insurance.

Column 16, tax-free overseas annuity income.

Column 17, tax-free income.

Column 18, PIE income in annuity has been disclosed.

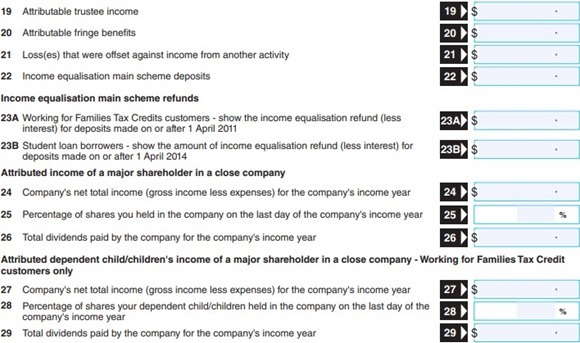

Columns 19-29, incomes from self-employment/trust/investment/lease. If you do not have such income, you do not need to fill in this column.

Column 19, income of the trustee.

Column 20, FBT income.

Column 21, which can be used to offset tax losses.

Column 22. Deposits.

Column 23A, Working for family income.

Column 23B, Student loan income.

Column 24, company revenue.

Column 25 is the shareholding ratio of the company.

Column 26, dividend income.

Columns 27 to 29 are about your child's dividends at the company.The specific content is the same as required for 24-26.